Take control of your finances with business budgeting software built for real-time decision-making. GlassJar helps you plan ahead, reduce waste, and stay on top of every dollar.

What is business budgeting software?

Business budgeting software is a digital tool that helps companies plan, track, and manage their financial budgets. Whether you’re forecasting monthly expenses or preparing for year-end reporting, our small business budget software simplifies it all.

The #1 Business Budget Management Software

Try GlassJar For Free

Simplify Your Budget Planning Process

Automate Time-Consuming Budget Tasks

Traditional budgeting often means juggling spreadsheets, formulas, and scattered financial data. GlassJar’s business budgeting software eliminates the manual work by automating data collection, syncing live bank feeds, and updating forecasts in real time. This removes errors, saves time, and gives you confidence in every number.

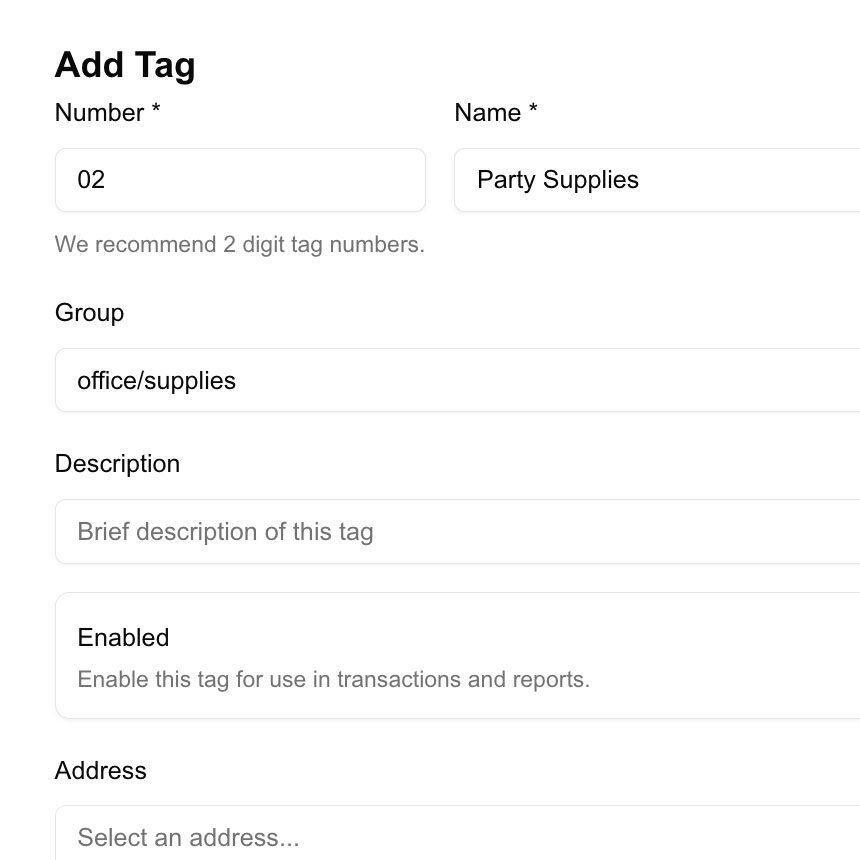

Built for Small Businesses and Growing Teams

Whether you’re a solopreneur or managing a growing team, our intuitive setup flow makes it easy to get started without any technical complexity. Customize your categories, set targets, and manage your budgeting process from a user-friendly interface designed for non-accountants.

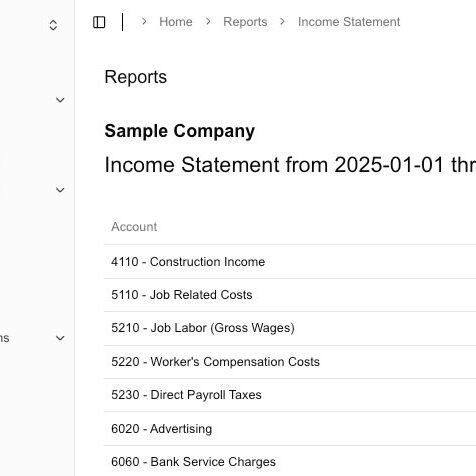

Dashboards That Drive Smarter Decisions

Stay informed with real-time dashboards that give a full view of your financial performance. Instantly see how your actuals compare to your planned budget, spot potential overruns, and make strategic adjustments with just a few clicks. Dashboards are clean, visual, and easy to share across your team.

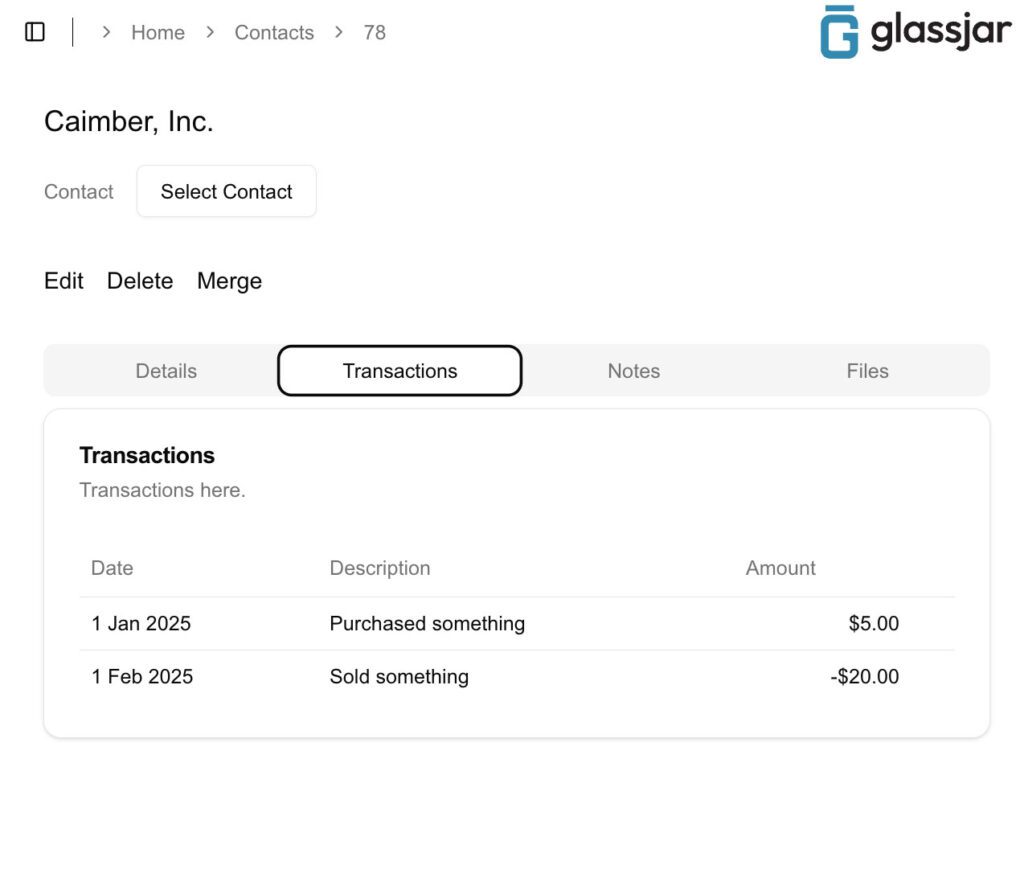

Connected to Your Full Accounting Workflow

GlassJar integrates with the full suite of accounting features, so your budgeting process connects naturally with expense tracking, invoicing, and reporting. It’s all built to scale as your business grows—one login, one workflow, total control.

Built for Teams: Collaborative Budgeting

Enable your finance team, operations staff, and leadership to collaborate in one seamless flow with a budgeting tool built for clarity and control. GlassJar goes beyond Excel by offering advanced features tailored to each team’s needs—making strategic planning and day-to-day budgeting easier, faster, and more connected.

Track Spending in Real Time

Monitor expenses effortlessly with real-time budget tracking. See where your money is going, compare actual spending vs. planned budgets.

Gain Cash Flow Insights

Visualize your financial health with interactive charts and reports. Get clear insights into your income, expenses, and cash flow trends, helping you make data-driven decisions to grow your business.

Automate & Simplify Budgeting

GlassJar syncs with your accounting and banking data to automatically categorize transactions, update budget balances, and alert you when you exceed limits.

Forecast Budgets with Speed and Precision

GlassJar’s business budgeting software helps you go beyond historical reports by transforming past spending patterns into forward-looking insights. Spot upcoming windfalls, identify seasonal fluctuations, and forecast growth or cost increases with precision—giving business owners and shareholders greater visibility into what’s ahead.

Run What-If Scenarios in Seconds

Quickly model the financial impact of real-world decisions. Whether you’re doubling inventory, adding new labor, or adjusting marketing spend, GlassJar allows you to simulate changes and instantly see how they affect your overall budget, profit margins, and cash flow projections.

Align Stakeholders with Smarter Forecasts

From leadership to finance teams, everyone stays on the same page. Share visual forecasts and predictive models that help teams collaborate on strategic planning with confidence. GlassJar’s intuitive budgeting tool makes it easy to communicate complex scenarios with clear, digestible insights.

Fast, Flexible, and Built for Small Business Growth

Whether you’re preparing for a major investment or simply planning month-to-month, GlassJar gives you the speed and control to forecast accurately and make informed decisions—without relying on outdated Excel templates or clunky workflows.

Why Use GlassJar for Budgeting?

✔ Easy budget creation tailored to your business needs

✔ Real-time expense tracking to stay within limits

✔ Cash flow insights for smarter financial planning

✔ Automatic transaction categorization for accuracy

✔ Seamless integration with your accounting data

Stay on Budget and See Why Businesses Choose GlassJar

Take the guesswork out of budgeting and start making confident, data-driven financial decisions with ease. GlassJar’s all-in-one budgeting tool helps you plan, track, and adjust in real time—without relying on outdated spreadsheets or manual processes.

Try GlassJar for free today and experience full control over your business finances, with the flexibility to grow, adapt, and lead with confidence.

9 Reasons Why Thousands Of Small Businesses Manage Their Budgets With GlassJar

Most small to midsize businesses struggle to maintain accurate financial visibility across teams, departments, and revenue streams. Traditional spreadsheets fall short, and generic accounting tools lack the intelligence and structure required for true financial performance planning. GlassJar fills this gap by providing an integrated platform for financial planning, forecasting, and real-time collaboration—helping businesses evolve from reactive reporting to strategic forecasting.

Unlike basic budgeting templates, GlassJar provides a complete FP&A toolset designed for simplicity without sacrificing power. Whether you’re preparing for a funding round, adjusting for seasonal shifts, or monitoring liquidity, the system enables business owners and finance leaders to generate actionable insights on demand.

1. FP&A Built for Today’s Small Business Environment

Financial Planning and Analysis (FP&A) was once reserved for large enterprises with dedicated finance teams and sophisticated enterprise software. GlassJar changes that. By incorporating FP&A principles into a modern interface, the platform empowers businesses to plan, model, and adapt without requiring expensive consultants or complicated software.

Users can build rolling forecasts, manage multiple scenarios, and integrate revenue assumptions alongside real expense data. The interface is designed for non-experts but robust enough for seasoned analysts. With built-in tools for actual vs. plan comparisons, cash flow modeling, and headcount forecasting, GlassJar delivers a real FP&A framework at a fraction of the cost of legacy systems.

2. Consolidation That Works Across Accounts and Departments

When data lives in different silos—across departments, business units, or even spreadsheets—reliable consolidation becomes difficult. GlassJar eliminates this issue by integrating all financial sources into a unified system. Departmental budgets, payroll projections, sales targets, and vendor contracts all flow into one central forecasting engine.

This process enables financial teams to consolidate without manual manipulation. Instead of adjusting links and formulas every time a number changes, GlassJar updates data automatically based on connected inputs. This reduces errors, accelerates close cycles, and improves overall data integrity.

Through this lens of automated consolidation, leadership can focus on strategic outcomes rather than reconciliation. Teams gain confidence that their financial picture is accurate, consistent, and current.

3. Advanced Forecasting with Real-Time Data

Forecasting is no longer a once-per-quarter activity. Markets shift quickly, client demands evolve, and expenses fluctuate due to supply chain dynamics and staffing changes. GlassJar supports agile decision-making by enabling dynamic financial forecasting powered by real-time data.

Instead of exporting spreadsheets, making manual updates, and emailing static files, teams can update assumptions directly within the platform. Each change triggers real-time updates across forecast models, variance reports, and operational dashboards.

The system’s forecasting software accounts for multiple variables, such as revenue growth, hiring plans, cost of goods sold, and seasonal trends. Forecasts can be adjusted mid-cycle and instantly evaluated against budget or prior year benchmarks. This enables proactive adjustments to spending, hiring, and pricing strategies.

4. Integrated Balance Sheet Planning for Long-Term Visibility

Cash flow isn’t the only metric that matters in planning. Understanding how operational decisions impact your balance sheet is key to long-term health. GlassJar incorporates automated balance sheet forecasting so that every adjustment to expenses, income, or investments is reflected in assets, liabilities, and equity positions.

As you build forward-looking financial plans, GlassJar helps you visualize how deferred revenue, inventory, and accounts receivable affect your future cash position. This planning extends across quarters or years, giving you visibility beyond the income statement alone.

Because the balance sheet forecast updates dynamically with every plan change, you can ensure capital structure decisions are grounded in forward-looking insights, not backward-looking summaries.

5. ERP-Ready Architecture Without the ERP Headache

Larger companies rely on ERP systems to manage operations, accounting, inventory, and finance—but these platforms are often overkill for smaller teams. GlassJar offers ERP-style functionality with a modern, user-friendly experience. Instead of being locked into a rigid system, you get flexible tools for financial planning, operational visibility, and cross-functional alignment.

GlassJar integrates cleanly with your existing tools—whether it’s payroll, accounting software, CRM, or BI platforms. This makes it possible to sync live data into your forecasts without investing in a full ERP stack. For businesses scaling into more complex operations, GlassJar provides the forecasting and modeling strength of an ERP environment, but with less friction and lower overhead.

This hybrid approach allows businesses to maintain ERP-like discipline in planning without locking into expensive or bloated software ecosystems.

6. Scenario Modeling and Strategic Forecasting Tools

GlassJar allows you to build multiple what-if scenarios using actual historical data, projected assumptions, and dynamic drivers. Whether you’re preparing for a new product launch, uncertain economic conditions, or a major hiring plan, these models help quantify potential outcomes.

Each scenario lives in its own versioned model, where teams can adjust revenue drivers, expense ratios, sales headcount, and marketing spend without affecting the main budget. Once modeled, scenarios can be compared side by side—enabling clearer decision-making based on risk, investment levels, and revenue projections.

This scenario functionality brings powerful forecasting software capabilities to businesses of any size, enabling planning teams to ask better questions, explore contingencies, and prepare for volatility.

7. Role-Based Access and Department-Level Ownership

Financial planning isn’t just for finance anymore. With GlassJar, different team leads can own their own budget lines and assumptions while the finance team retains control over structure and rules. This promotes collaboration while maintaining control over critical inputs and templates.

The platform supports role-based access so that sales, marketing, operations, and HR teams can view or edit their own forecasts without having access to confidential company-wide financials. These contributions roll up into a unified budget and forecasting model—allowing decentralized planning without losing financial discipline.

This setup mirrors what sophisticated FP&A teams achieve with large-scale platforms, without requiring external consultants or extensive onboarding.

8. Real-Time Insights for Smarter Monthly Reviews

Finance teams spend a disproportionate amount of time preparing reports, often using static tools that are already outdated by the time they reach decision-makers. GlassJar solves this by providing live dashboards that reflect real-time data tied to actual transactions, updated forecasts, and categorized budgets.

During monthly reviews, leadership can drill down into specific spend categories, compare actual vs. planned performance, and evaluate the financial impact of operational decisions. Because the platform is connected to your actual data sources, there’s no need to wait on exports or spend time reformatting spreadsheets. Reports are always current, always accurate.

These reviews evolve from reactive summaries into forward-looking discussions grounded in live metrics and business performance.

9. Align Strategy with Financial Forecasting

A budget is just one piece of the planning puzzle. GlassJar extends financial workflows beyond budgeting into full financial forecasting that ties in growth plans, hiring goals, margin improvement efforts, and capital investments.

Instead of treating finance as a record-keeping function, GlassJar enables alignment between finance and strategy. Budgets are no longer isolated documents—they are living models that reflect evolving business plans and respond to changes in real-time data.

For example, if a sales pipeline expands faster than expected, forecasted revenue adjusts accordingly. Hiring plans can be modeled around new revenue targets, and projected expenses are recalculated automatically. The result is a system that helps businesses plan not only based on numbers but based on outcomes.

Frequently Asked Questions

What is the best business budgeting software?

The best business budgeting software depends on your needs, but top options include GlassJar, QuickBooks, PlanGuru, and Float. GlassJar is ideal for small businesses seeking real-time tracking, automation, and ease of use.

PlanGuru offers advanced forecasting tools, while Float integrates with accounting platforms for cash flow insights. Look for software that supports multiple users, customizable budgets, and report sharing.

Is QuickBooks good for business budgeting?

QuickBooks is a solid option for basic business budgeting. It allows users to create budgets by class, track actuals vs. projections, and generate standard financial reports.

However, it lacks robust forecasting and multi-scenario planning features. Businesses needing more advanced controls or easier collaboration may benefit from alternatives like GlassJar or PlanGuru.

What is budget management in business?

Budget management in business refers to the process of planning, monitoring, and controlling income and expenses to ensure financial stability and meet company goals. It involves setting budgets, tracking actual spending, adjusting forecasts, and analyzing performance against targets.

Effective budget management helps businesses allocate resources wisely, reduce waste, and make informed financial decisions.

How do I create a budget for my small business?

Start by listing all fixed and variable expenses. Estimate monthly income, then allocate funds by category (marketing, payroll, inventory, etc.). Use budgeting software like GlassJar to track spending, flag overruns, and adjust as needed.

Include a cash reserve and regularly review actuals vs. projected amounts to stay on track. Revisit the budget quarterly or as your business changes.

How often should I update my business budget?

Budgets should be reviewed monthly and updated at least quarterly. This allows your business to respond to changing revenue, unexpected costs, or market conditions.

Updating your budget ensures your projections stay aligned with real-world performance and gives you time to adjust before issues arise.

Can I manage a business budget without accounting experience?

Yes. Many modern budgeting tools are designed for non-accountants. Platforms like GlassJar use simple dashboards, automation, and alerts to guide you through budgeting tasks without needing a finance background.

You can set permissions, delegate tasks, and generate easy-to-read reports for stakeholders.

Why is budgeting important for small businesses?

Budgeting provides visibility into your finances and helps ensure you don’t overspend. It also gives you a roadmap for reaching profitability, scaling operations, or investing strategically.

Without a clear budget, small businesses are more prone to cash flow issues, missed opportunities, and financial instability.