Our accounting software is designed to simplify the way you track income, expenses, and everything in between. Whether you’re using it as a bookkeeping app, an accounting app, or a full online accounting software solution, it’s built to support small businesses with ease.

This simple bookkeeping software gives you the essential tools without the clutter—ideal as a basic accounting software or a complete small business accounting program.

Explore Top GlassJar Features

How We Help Accountants Stay On Track

GlassJar is more than just accounting software—it’s a smarter, simpler way to stay organized, accurate, and ahead of the curve. Built to support the unique workflows of modern accountants, our platform offers intuitive tools that help eliminate busywork and reduce errors before they happen.

Whether you’re managing multiple clients or reconciling a single business account, GlassJar makes it easy to keep everything on track. Use built-in bookkeeping software to automatically sync transactions, generate real-time reports, and stay tax-ready year-round.

Our Core Features

Less Clicks

Do more with less clicks. Add entries and people of any type in one place.

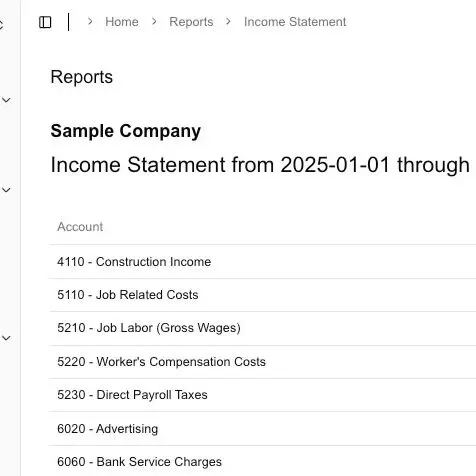

Report On Anything

Combine any type of data with our drag-and-drop report builder.

No Duplicate Contacts

Contacts can be both a customer and vendor at the same time.

Data Friendly

Run reports and export small to large data files with ease and lag-free.

Better Audit Logs

Reliable audit logs that don’t continuously spiral into oblivion.

It’s Not QuickBooks

We took the things that people dislike about QuickBooks and fixed them.

GlassJar’s accounting tools are purpose-built to integrate smoothly, giving you a clear financial picture without the clutter or complexity.

Sign Up To Get EARLY ACCESS To GlassJar

Be the first to know when GlassJar accounting software launches in your area—sign up for updates today.

Accounting Software So Good It Makes You Want To Hug Your Kids

Accounting is about more than numbers—it’s about confidence. With GlassJar, you’re equipped to do your best work without second-guessing your tools. Our software eliminates manual errors, streamlines routine tasks, and keeps everything in sync so you can spend less time double-checking and more time with things that matter.

Streamlined Financial Management: Your All‑In‑One Solution

Our platform offers a comprehensive, all in one financial management solution designed to simplify and centralize your accounting workflows. Every component is engineered to automate repetitive tasks, improve accuracy, and give you complete visibility into your financial health.

Effortless Integration with Credit Card Transactions

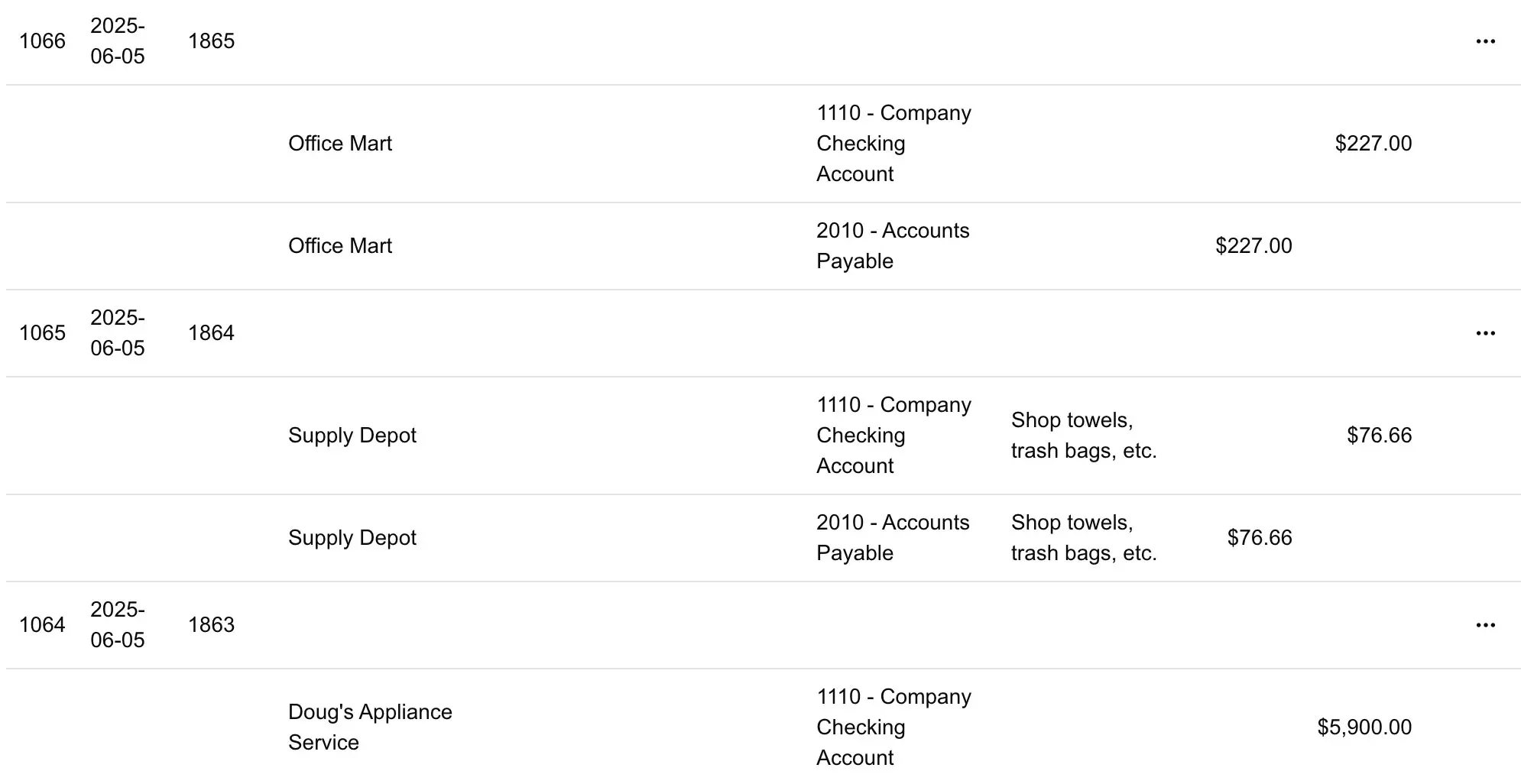

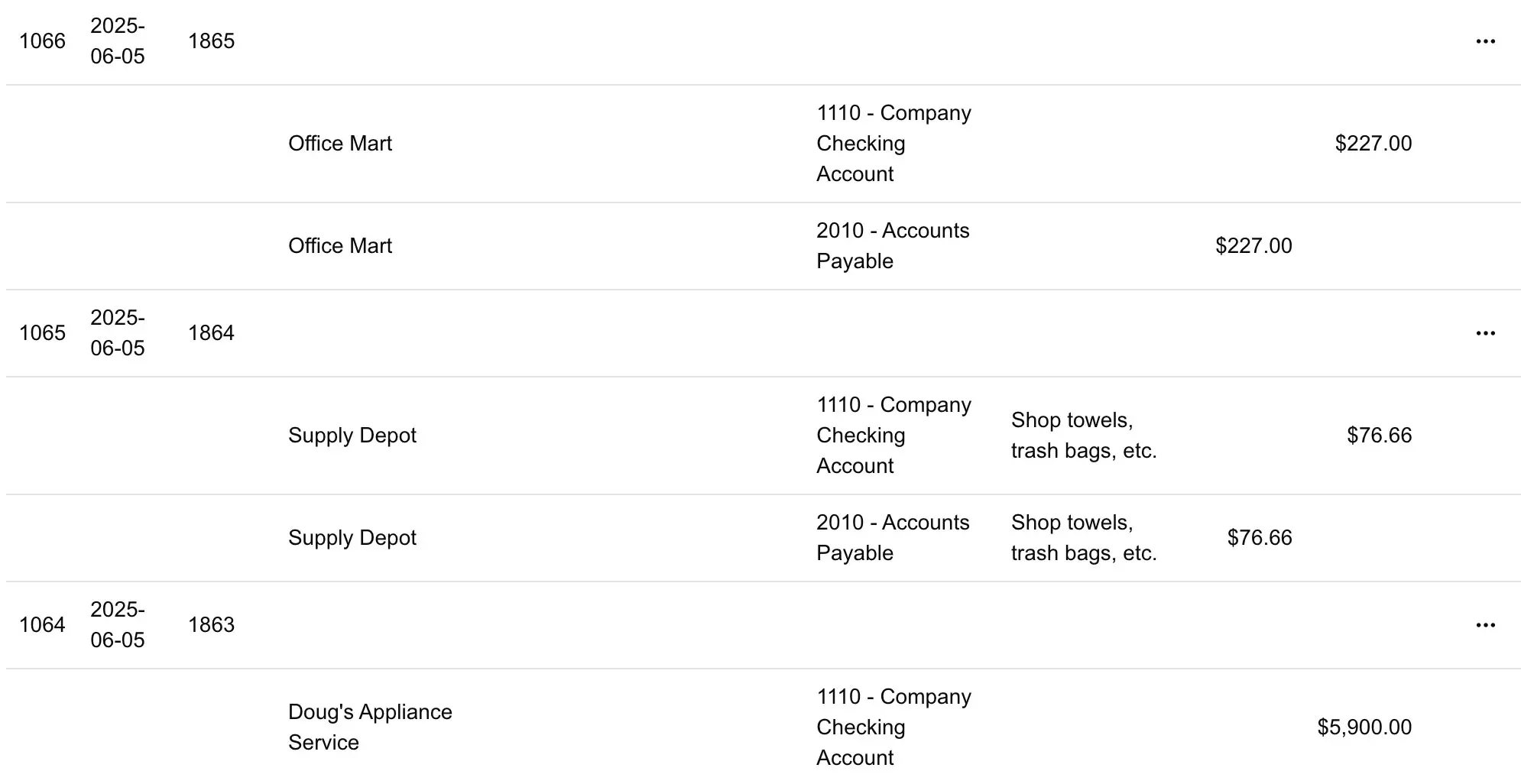

One of the standout features is seamless credit card data integration. No more manual imports or error-prone copy‑pasting. Once you link your credit card accounts, GlassJar automatically pulls in transaction details, vendor names, dates, and amounts. These entries appear in real time, ready for review. This ensures your balance sheet is always updated with the latest liabilities and expenditures. It also empowers you to monitor spending, plan budgets, and reconcile balances without needing to log into banking portals.

Intelligent Categorization and Automated Bookkeeping

Categorizing transactions is essential for accurate financial reporting. Our software uses smart rules and machine learning to categorize expenses automatically, based on vendors, amounts, and user behavior. Recurring transactions—such as monthly subscription fees, utility bills, or vendor charges—are recognized and categorized automatically once defined. This feature reduces manual errors, saves hours each month, and ensures consistency for accounting and tax preparation purposes.

Manual overrides are always available. If a transaction is misclassified, you can quickly adjust the category, and the system learns from your correction moving forward, continuously improving accuracy across all your bookkeeping.

Automated Reconciliation and Balance Sheet Updates

The platform’s powerful reconciliation engine contrasts imported credit card entries against your uploaded or linked bank statements. Unmatched entries are flagged for your review. Confirmed matches are posted to the balance sheet, updating asset and liability accounts in real time. This means you always have access to up‑to‑date financial positions, with accurate values in current assets, credit card liabilities, and cash reserves.

Because the process is largely automated, reconciliation time is reduced from hours per month to mere minutes, letting you focus on analysis instead of data entry.

Consolidated Reporting: One Dashboard for Multiple Accounts

Since GlassJar is an all in one platform, it consolidates data from credit cards, bank accounts, invoices, and expenses in one central dashboard. You can:

- Review current credit card balances next to cash balances

- See categorized expense breakdowns across vendor types

- Access visual charts on monthly spending by category

- Monitor liabilities and net assets on your balance sheet

Everything feeds into live financial statements. You can drill down into any category, remove or reassign entries, and view historical trends.

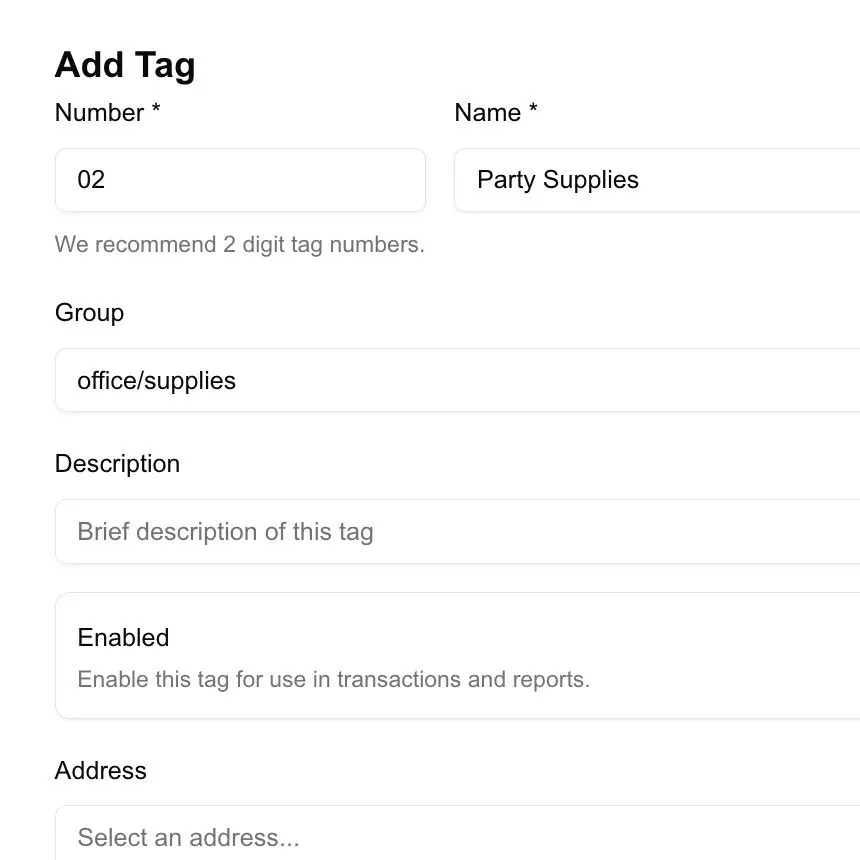

Custom Rules for Speed and Accuracy

To enhance efficiency, you can define custom rules for transaction categories, keywords, vendors, or amounts. For example, any transaction over $500 tagged “Marketing” is automatically routed to the Marketing Budget category. Rules let you scale the automated system easily and maintain consistent bookkeeping across growing volumes.

Audit Ready Documentation and Compliance

Every transaction, including credit card charges and manual adjustments, is timestamped and traceable. Audit logs show who categorized or edited entries and when changes were made. The platform stores receipts, statements, and memos alongside each transaction. This helps maintain clean records for tax season, audits, or regulatory compliance, with confidence and reduced risk.

Scalability that Grows with You

Whether you handle a small business, freelance consulting, or a mid‑sized operation, this all in one system adapts. Multi‑user access allows you to assign roles to team members, approving credit card charge entries, vendor categories, or monthly reconciliations. Historical balance sheet data across multiple periods is preserved, enabling quarterly or annual trend analysis and comparison.

What Makes GlassJar a Leading Accounting Solution?

By integrating each module—expenses, invoicing, budgeting, inventory, tax compliance—into a single ecosystem, GlassJar positions itself as more than a sum of its features. It’s a unified accounting solution crafted to eliminate friction, reduce errors, and enhance visibility.

For small business owners, that means accurate numbers, predictable cash flow, and strategic planning. It easily qualifies as best accounting software because it addresses real challenges while staying intuitive and accessible.

15 Reasons Why Thousands Of Small Businesses Are Switching To GlassJar

Small business owners often juggle multiple priorities—operations, marketing, customer care—while bookkeeping slips into the background. What they truly need is a cohesive accounting solution that automates data management and surfaces useful insights.

1. Strengthen Cash Flow with a Holistic Accounting Solution

GlassJar’s platform isn’t just another bookkeeping app; it’s a full-fledged accounting solution designed to support growth while maintaining control. By offering secure bank integration, seamless transaction syncing, and real‑time cash‑flow visibility, it empowers small business owners to track funds without dedicating hours to manual entry.

In this way, it claims a place among the best accounting software options for those seeking simplicity without sacrificing sophistication.

2. True Automation—More Time, Fewer Mistakes

One of the markers of the best accounting software for small business owners is how much manual work it removes. GlassJar reflects that standard by automating repetitive tasks: uploading and matching receipts with expenses, labeling transactions according to custom rules, and syncing every check printed back into the general ledger.

All of this lowers error risk while freeing up time for core business activities. Companies who switch report less time spent on month‑end close and zero discrepancies in vendor payments or invoice processing.

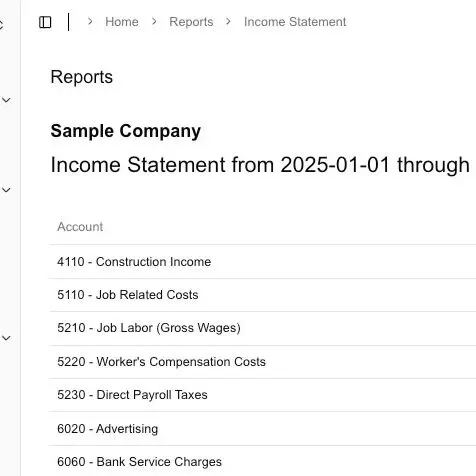

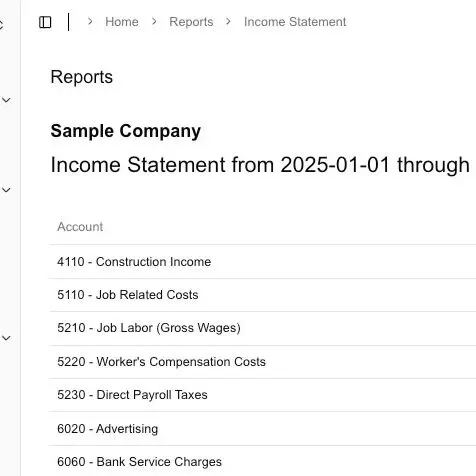

3. Smart, Contextual Financial Reporting

When evaluating accounting solutions, small business owners often ask: “Will I get actionable insights, or just raw numbers?” GlassJar goes beyond static reports. Its drag‑and‑drop report builder lets you analyze sales, expenses, or cash flow in one cohesive interface. Want to compare two periods? Want to see profit margins by project or client?

Customize your insights, save report templates, and export them when needed. As the report library grows, your small business benefits from more context and less guesswork between the numbers.

4. Supporting the Needs of Contractors and 1099 Compliance

When evaluating accounting solutions, small business owners often ask: “Will I get actionable insights, or just raw numbers?” GlassJar goes beyond static reports. Its drag‑and‑drop report builder lets you analyze sales, expenses, or cash flow in one cohesive interface. Want to compare two periods? Want to see profit margins by project or client?

Customize your insights, save report templates, and export them when needed. As the report library grows, your small business benefits from more context and less guesswork between the numbers.

5. Built‑In Expense Management Tools

Rather than relying on spreadsheets and shoeboxes of receipts, modern small business owners need mobile, digital expense tools. GlassJar delivers: snap pictures of receipts, assign them to project codes or expense categories, and let the software match them to bank transactions.

The result is consistent and audit‑ready records that reduce friction during tax preparation. Real‑time reporting ensures that decision makers stay informed before expenses erode margins.

6. Check Printing with Brand Continuity

Though digital payments rise, small business owners often still rely on physical checks for vendor or payroll needs. GlassJar’s check printing feature is tailored for this purpose: it lets you brand your documents, maintain consistent layouts, and seamlessly record every check in your books.

This combination of polished checks and automatic journal entries helps maintain professional credibility while keeping your accounting records accurate.

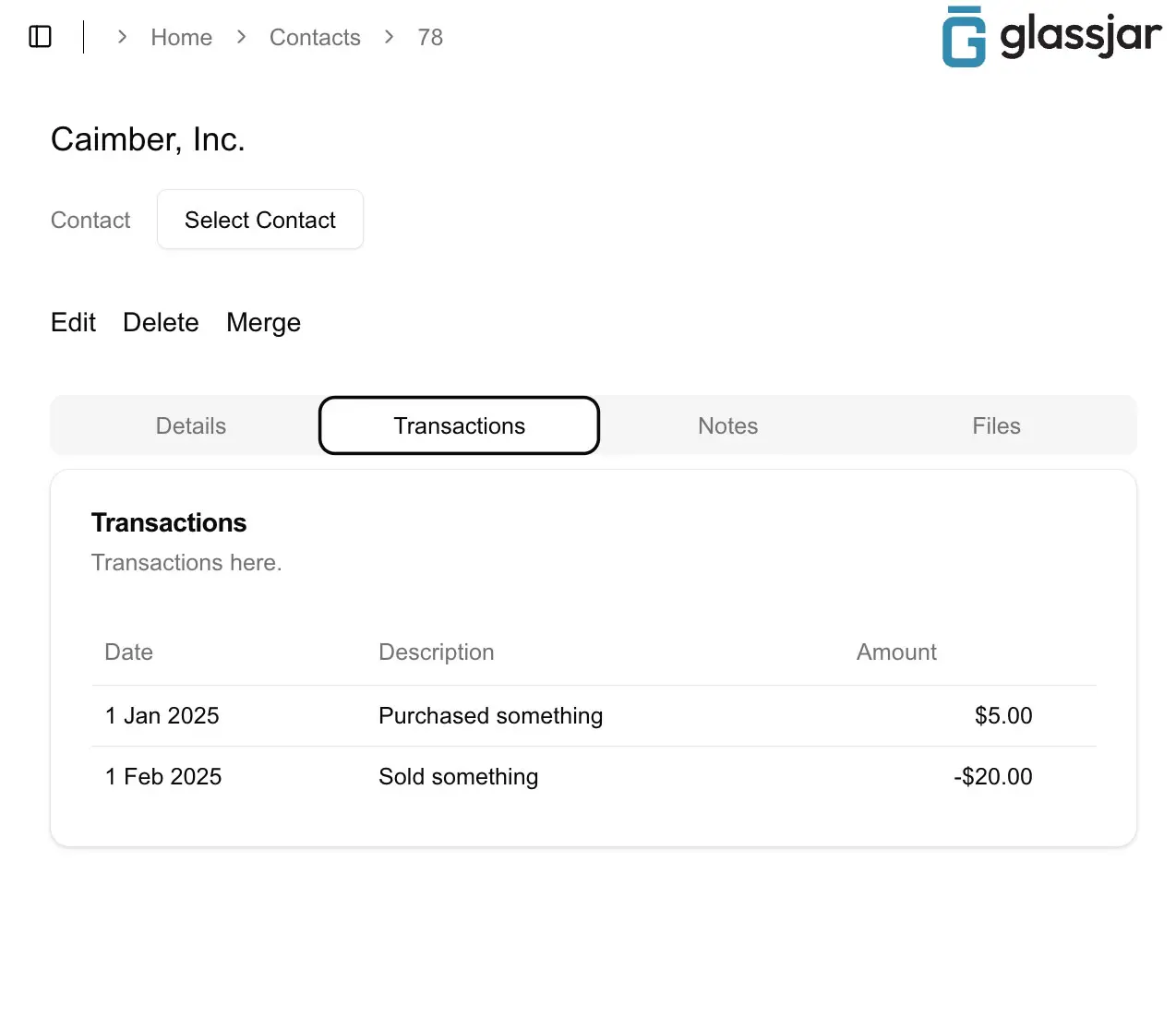

7. Contact Management That Helps You Grow

The best accounting software isn’t only about ledgers—it’s also about managing relationships. GlassJar lets each contact double as vendor and customer, avoiding duplicate records.

You can track payment histories, open invoices, and overdue balances for every relationship. That single‑view approach simplifies follow‑ups and helps businesses maintain cleaner financial records.

8. Intelligent Inventory and Sales Integration

Small businesses in retail or e‑commerce can’t afford inaccurate inventory counts. GlassJar tracks inventory in real time, updating levels with each sale and adjusting stock on receipt. It can trigger alerts for low inventory, help you reorder, and ensure that accounting reflects the true cost of goods sold and gross profit margins.

A reliable inventory system makes GlassJar an ideal accounting solution for growing product‑based small businesses.

9. Transactional Control with Audit‑Grade Logs

Accuracy is critical in accounting. GlassJar logs every transaction, change, or adjustment, maintaining an audit trail that builds trust. Owners, bookkeepers, or accountants can see when figures change and understand the reasoning behind it. This accountability strengthens your internal controls and simplifies year‑end reviews or audits.

10. Reporting Trends for Strategic Growth

Once basic bookkeeping is under control, the next level of accounting solution helps businesses scale. GlassJar supports trend reporting—such as monthly sales growth, profit margin shifts, and expense ratios.

These metrics guide decisions like expanding services, adjusting pricing, or reallocating marketing budgets. The smart use of data turns bookkeeping into strategy, making GlassJar stand out among top-tier accounting software for growth‑minded entrepreneurs.

11. Scalability That Matches Your Ambition

Small business owners outgrowing spreadsheets need a system that grows with them. GlassJar is built for scale: it supports multiple users, layered permissions, and numerous company profiles.

Whether managing one venture or several, its accounting architecture adapts without downtime. That scalability prevents the need for disruptive migrations when revenue hits the next level.

12. Why GlassJar Ranks Among the Best Accounting Software

What makes a tool truly count as small business accounting software? Beyond features, the answer lies in how it integrates into daily workflows. GlassJar focuses on built-in cohesion—bank connections that auto‑sync, expenses that attach to receipts, invoices that mirror actual sales, and checks that log themselves.

Every module interlinks within a single system. This unity improves financial accuracy and streamlines time tracking, billing, and compliance. And that’s precisely why entrepreneurs consider it the best accounting software choice.

13. Adopting GlassJar: A Stress‑Free Transition

Switching accounting software can feel risky. That’s why GlassJar emphasizes clean onboarding. You start with your current data—bank connections, existing contacts, open invoices, live inventory—and GlassJar builds your maiden ledger based on real-time information.

You can continue with previous practices in parallel until you’re comfortable. This approach minimizes friction and makes the adoption feel gradual, not abrupt.

14. Tax‑Ready Bookkeeping Made Simple

For small business owners, tax deadlines are often stressful. GlassJar simplifies compliance: everything from 1099 contractor payments to sales tax tracking is organized within the platform.

Reports that once took accountants days to assemble are condensed into ready‑to‑export files. That organization saves time and reduces the cost of external tax services.

15. Collaborative, Yet Secure Financial Access

Even solo entrepreneurs need occasional assistance. GlassJar enables role‑based access: bookkeepers, accountants, or advisors can log in with limited privileges.

They can update financial records without viewing sensitive payroll or sales data. This collaborative structure ensures expert support without compromising data integrity.

Sign Up To Get EARLY ACCESS To GlassJar

Stay ahead of the curve by getting notified when GlassJar accounting software becomes available in your area.