Search from our library of reports to add to your account.

Accounting reports are structured documents generated by accounting software or financial systems to present financial information about an organization. These reports provide insight into revenue, expenses, assets, liabilities, and equity. They form the basis of decision-making, regulatory compliance, and financial transparency.

Income Reports

Open Invoices Report

The Open Invoices Report is a critical accounting tool that gives businesses a real-time view of all…

Sales by Customer Report

The Sales by Customer Report in GlassJar gives businesses a detailed breakdown of total sales attrib…

Expense Reports

Cost Of Goods Sold Report

The Cost of Goods Sold (COGS) Report is a core component of business accounting that directly influe…

Expenses By Vendor Report

The Expenses by Vendor Report is a powerful financial reporting tool available in GlassJar that show…

Contact Reports

Vendor Details Report

The Vendor Details Report in GlassJar provides a complete, transaction-level overview of all financi…

Customer Details Report

The Customer Details Report in GlassJar is a centralized, transaction-level report that provides a c…

Types of Common Accounting Reports

Balance Sheet

A balance sheet, one of the core accounting reports, presents the financial position of a business at a specific point in time. It lists assets, liabilities, and equity, illustrating how resources are financed.

Income Statement

Also known as a profit and loss statement, this accounting report summarizes revenues and expenses over a period, showing net profit or loss. It offers insight into operational performance and cost control.

Cash Flow Statement

This accounting report shows actual cash inflows and outflows from operations, investing, and financing. It helps stakeholders understand liquidity and cash management.

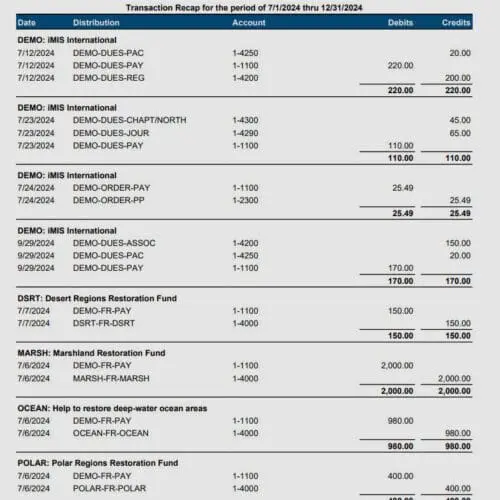

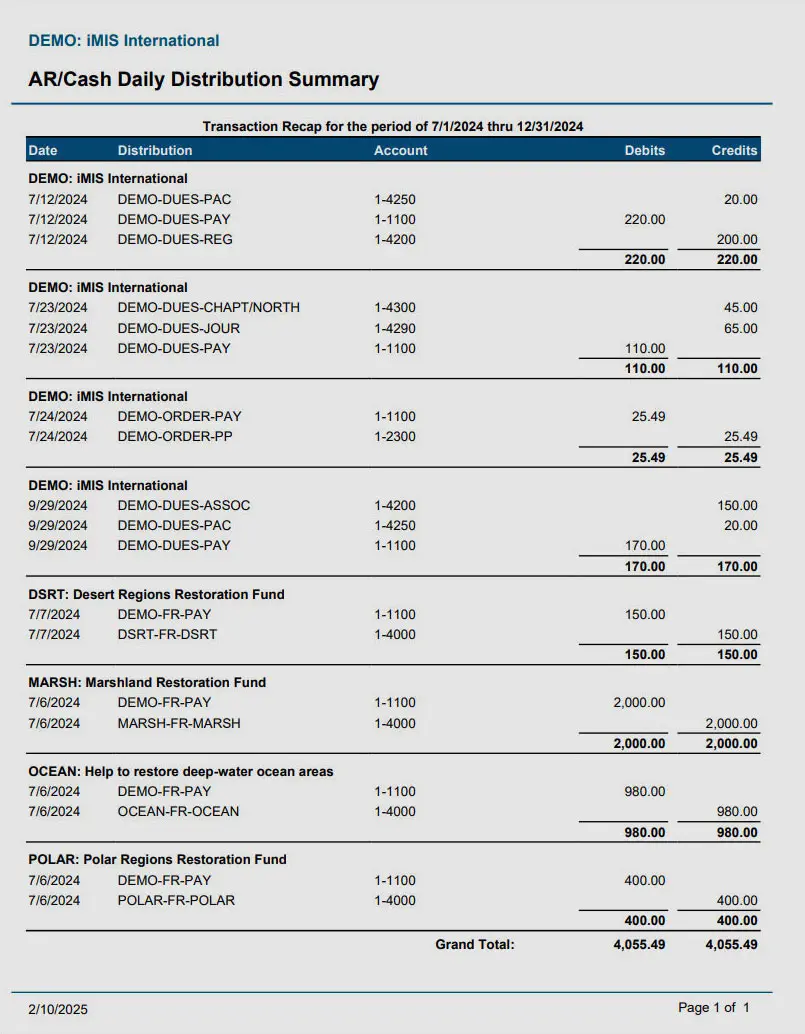

Accounts Receivable and Payable Reports

These accounting reports detail amounts owed by customers (open invoices) and owed to vendors (expenses and payables), enabling better cash flow forecasting and collections management.

Custom Accounting Reports

Reporting Templates and Report Library

Modern accounting software provides users with a report library—a customizable repository of accounting reports. Users can build and save templates tailored to their needs, such as sales by customer, expenses by vendor, or cost of goods sold.

Unlimited Custom Accounting Reports

Many small business accounting systems enable unlimited creation of custom accounting reports. Users can build drag-and-drop financial reports, compare multiple periods, and save templates within the report library for reuse.

Export and Presentation Options

Custom accounting reports can be exported in formats like PDF, CSV, or Excel, making them shareable with stakeholders, accountants, or tax professionals. Software often automates this process, reducing manual errors.

Benefits of Comprehensive Accounting Reports

Improved Financial Visibility

Comprehensive and accurate accounting reports highlight key financial metrics—like profit margin, expense ratios, and cash flow trends—empowering better decision-making.

Efficiency and Automation

Automated generation of accounting reports eliminates time-consuming manual compilation. This allows small businesses to generate month-end financials or customized reporting quickly.

Strategic Trend Analysis

Trend accounting reports, such as year-over-year revenue growth or quarterly expense shifts, provide context. They help owners assess organizational health and plan for seasonal or cyclical changes.

Compliance and Audit Readiness

Accounting reports, supported by audit-grade logs and transactional traceability, facilitate compliance with tax and legal requirements. This ensures financial documentation is accurate and defensible.

How GlassJar Uses Accounting Reports to Support Businesses

Report Library Overview

GlassJar offers a report library that stores a variety of preset accounting reports, including open invoices, expenses by vendor, cost of goods sold, and sales by customer.

Drag-and-Drop Report Builder

Users can craft tailored accounting reports via a drag-and-drop interface. The platform allows filtering, grouping, and comparative period analysis for deeper insight into transactions.

Saving Templates and Automating Delivery

Once constructed, accounting reports can be saved as templates in the report library and scheduled for automatic generation or export. This supports regular financial review processes.

Integration with Invoicing, Expenses, Inventory and Budgeting

Accounting reports consolidate data across modules—such as expense tracking, invoicing, inventory, and budgeting—offering a cohesive view of financial operations.

Scalability and Historical Data Analysis

GlassJar preserves historical balance sheet data and supports multi-period trend accounting reports. This makes it possible to analyze performance over quarters or years.

Key Accounting Reports and Use Cases

Open Invoices Report

An essential accounting report for tracking accounts receivable. It lists outstanding customer invoices with due dates, helping ensure timely collection.

Sales by Customer Report

This accounting report breaks down sales revenue across different customers or client segments. It supports strategic insights into client performance and revenue concentration.

Expenses by Vendor Report

Used for analyzing procurement costs and vendor relationships, this accounting report details spending by vendor over time.

Cost of Goods Sold (COGS) Report

A vital accounting report for product-based businesses, showing the direct cost associated with inventory sold during a period. It helps determine gross margin.

Customer Details Report

Provides granular transaction-level accounting report data, such as customer history, open balances, and payment activity.

Budget vs Actuals Report

Compares actual performance to planned or projected budgets. This accounting report supports variance analysis and budget forecasting.

Advanced Accounting Reports for Strategic Planning

Trend Reports

These accounting reports track financial metrics over time—such as monthly revenue growth, profit margin shifts, or expense trends—to support strategic decisions.

Dashboard Reporting

Some platforms provide a visual dashboard that presents multiple accounting reports together—such as cash flow, profit, and expense breakdown—delivered in real time.

Comparative Multi-Period Reports

Accounting reports that compare two or more periods side by side—for example, Q2 sales vs Q3 sales or year-over-year revenue—help reveal shifts in performance.

1099 and Tax Compliance Reports

Certain accounting reports focus on contractor payments (1099 tracking) or sales tax liabilities, streamlining tax season preparation and regulatory reporting.

Best Practices for Using Accounting Reports

Regular Review Cadence

Schedule key accounting reports—such as profit and loss, balance sheet, and cash flow statements—for monthly review. This helps catch issues early and supports proactive decision making.

Leverage the Report Library

Utilize the accounting reports stored in the report library. Customize and reuse templates to maintain consistency and reduce repetitive work.

Customize to Your Business

Adjust fields, filters, and periods to tailor accounting reports to specific needs—such as tracking project profitability, departmental performance, or sales channel trends.

Automate Where Possible

Use software automation to generate accounting reports at regular intervals, export to preferred formats, and distribute automatically via email or file sharing services.

Ensure Data Accuracy

Reconcile transactions and bank feeds regularly so that accounting reports reflect up-to-date and accurate figures. Review logs and audit trails where discrepancies occur.

Combine Reporting with Analysis

Accounting reports offer data; strategic value appears when followed by analysis. Use insights from reports to inform budgeting decisions, pricing, hiring, or operational adjustments.

Common Challenges with Accounting Reports

Overwhelming Volume

As businesses grow, the number of available accounting reports expands. Without strong organization and naming conventions in the report library, users may struggle to find the right reports.

Report Performance and Speed

Large datasets can slow down report generation. Scalable accounting platforms mitigate this by indexing database records and optimizing report queries.

Data Context and Interpretation

Raw accounting reports may require added context or narrative to be meaningful—especially for non-financial stakeholders. Visualizations or brief commentary with report output can help.

Integration Errors

Accounting reports are only as accurate as the underlying data. Issues with bank integration, expense tracking, or transaction tagging can compromise report output.

Enhancing Accounting Reports Through Software Integration

Bank Feed Integration

Seamless bank and credit card integration feeds real-time transaction data into the accounting system. That ensures accounting reports—like cash flow and expense categories—are current and reliable.

Receipt Capture and Matching

Integrated expense management tools allow users to snap receipt images and match them directly to expense entries. That supports accurate categorization and reporting.

Contact and Customer Data

By linking invoice data with contact records, accounting reports like sales by customer and aging receivables become actionable and accurate.

Inventory Synchronization

Real-time inventory integration ensures that cost of goods sold and gross profit reports are timely and tied to actual stock movements.

Custom Tags and Reporting Dimensions

Tag data—such as by project, client, or product line—to add reporting depth. These tags become filtering dimensions in accounting reports.

Leveraging Accounting Reports for Future Growth

Setting KPIs via Accounting Metrics

Establish Key Performance Indicators based on accounting reports such as gross margin, expense ratios, or days-sales-outstanding. Use these as benchmarks for performance review.

Forecasting and Budgeting

Use historical accounting reports to identify trends and inform budgeting, cash flow projections, and financial planning.

Data-Driven Decision Making

Accounting reports provide the factual groundwork for decisions such as hiring, pricing, scaling operations, or exploring new products.

Supporting External Stakeholders

Accurate accounting reports support investors, lenders, advisors, or board members by providing clear financial transparency and accountability.

Continuous Improvement

Review and refine the accounting reports you use regularly. As business needs evolve, adjust templates, add new dimensions, or retire outdated reports.